Experience direct equity portfolio construction with a top-down asset allocation approach having the potential to generate a high risk-adjusted return.

Experience direct equity portfolio construction with a top-down asset allocation approach having the potential to generate a high risk-adjusted return.

Fully automated online platform that provides you with digital financial advice and portfolio allocation in line with your risk profile.

Compare different insurance policies and make an informed choice. Get our assistance in finding the most appropriate product for you.

>Wide range of Structured Offerings - Yield oriented offerings with fixed returns and Nifty linked structures. Other products include PMS, AIF, PE & Corporate FDs

Diversification

Superior return

Expert Fund Managers

Liquidity & Tax efficiency

Wide range of products

Safety & transparency

Empirical evidence suggests equities have outperformed other asset classes such as fixed deposit, gold, PPF, bonds, ULIP and real estate in the long term.

Mutual Fund is the best investment vehicle to own equity as it has consistently generated high return on investment through diversification.

Hi, I am your trusted friend and financial co-pilot. Come let's make investment delightful!

Diversification

Unbiased advice

Simple & Jargon-free advisory

Follow Portfolio approach

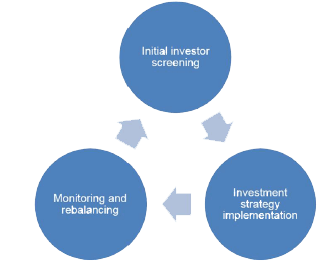

Constant monitoring & re-balancing

Regular Hypothesis testing

Metta Money works on the philosophy that "Same Size Does Not Fit For All". Every client is unique and therefore we use both "risk assessment" based on need/ability framework and his/her "experience and investment style" to create client's unique profile. Based on the risk profiling logic, we segment the clients into different risk buckets.

Our Robo-advisor also uses fund ranking and recommendation logics, developed by our expert panel having an average experience of over 13 years in the financial market. Depending on the market outlook, we endeavor to create the base portfolio mix and adjust it to take into account his/her risk and preferences to arrive at unique portfolio for our clients.

Are you looking for a higher interest rate on your deposits? Why not choose from a range of Corporate FDs.

Key Benefits:

1) Enjoy higher return from Corporate FDs as compared to Bank FDs.

2) Choose from a variety of payout options e.g. Monthly, Quarterly, Half-yearly or Yearly

3) Better liquidity with a lower lock-in period, as compared to bank FDs.

4) Avail the benefit of reduced risk vis-a-vis other bank-provided debt products as these FDs are backed by reputed rating agencies.

Are you planning to invest in mutual funds? Well, you can invest in mutual funds only if you are Know Your Customer (KYC) compliant. KYC is mandatory, regulatory and legal requirement for Mutual Funds investment.

We have partnered with one of the AMC to assist you in online KYC (eKYC) registration free of cost. Your eKYC registration process is without any strings attached and does not require you to buy any scheme of our partnering AMC for this service.