Are you thinking of becoming rich? I am sure your answer would be “YES”, unless you fall under the category of

irrational human being.

It is rightly said “becoming wealthy starts in your mind rather than your wallet”. Warren Buffett, who is seen as the god of wealth creation, did not become one of the wealthiest men in the world by suddenly striking gold in a single highly successful investment, but rather played the power of compounding as his firm Berkshire Hathaway witnessed 20%+ CAGR over more than half a century. Let’s assume you were born lucky as your parents/grandparents had the foresight to invest $10,000 in Berkshire Hathaway when Warren Buffet first took over (1964) which would be worth more than $260 mn as I write this blog. This is nothing but the sheer power of compounding and therefore it is rightly termed as the “8 th wonder of the world”. The power of compounding may not be very evident in the initial years of your investment but the magic becomes more pronounced in the later stage.

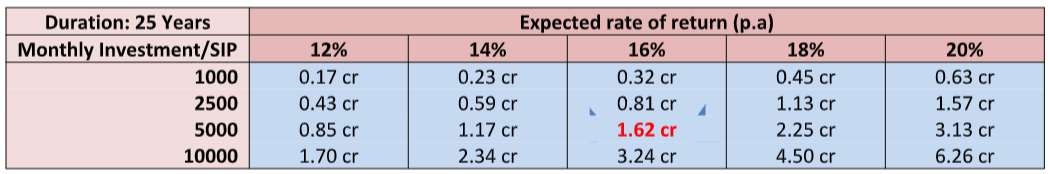

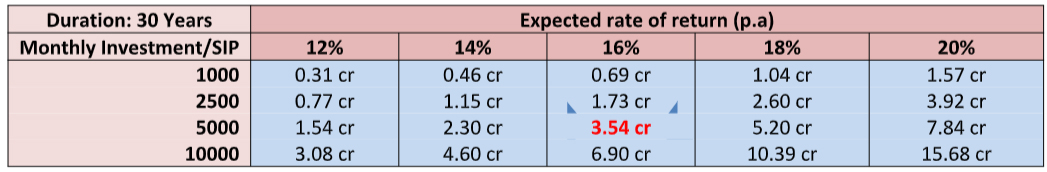

The above proposition would become much clearer if you spend some time looking at the following tables with two scenarios – 25 years & 30 years of SIP/monthly investments. Table-I shows the amount of wealth you will accumulate at the end of 25 years of monthly investments/SIP with different combination of SIP amounts and expected rate of return. E.g. If you invest Rs.5000 per month @16% p.a. expected rate of return, you will take home Rs.1.62 crore of accumulated wealth at the end of 25 th year. Similarly, Table-II shows how much wealth you can accumulate, if you invest Rs.5000 per month @16% p.a. expected rate of return…. Rs.3.54 crore!!! Yes, you read it right… you will accumulate Rs.3.54 crore at the end of 30 th year.

Table-I:

Table-II:

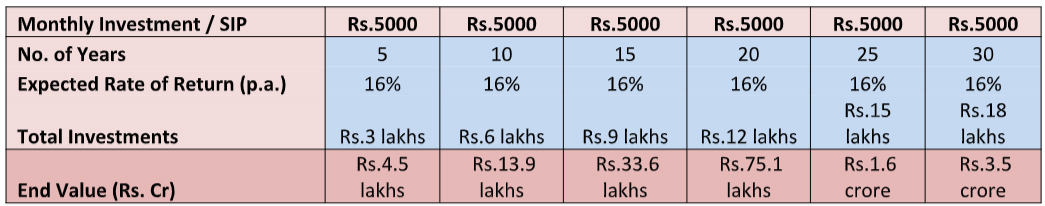

The below table can explain how the gap between your total investment and end value of your investment

(accumulated wealth) increases as the time horizon of your investment increases. E.g. If you invest Rs.5000 per month for 10 years @16% p.a. expected rate of return, you would accumulate Rs.13.9 lakhs at the end of 10 th year.

However, if you continue investing for additional 10 years, you would take home Rs.75.1 lakhs at the end of 20 th year. Suppose, you did not stop there and continued further for the next 10 years, you would end up amassing

whopping Rs.3.5 cr at the end of 30 th year. Now, I am sure you will appreciate how the power of compounding becomes more pronounced in the later stage of your investment phase.

Table-III

In simple words, it is like multiplier effect, where your earned interest from the initial capital also starts earning interest for you during the future period. In mathematical parlance, we can explain that value of your investment would grow at geometric progression rather than arithmetic progression. Before you start wondering as if we have lost the marbles, let me hold your attention. Now, you may ask – “even if the magic of compounding works, how is it going to help me”? How to benefit from the magic of compounding? Kindly hold your thought for few more moments!!! We will discuss how to play this game…

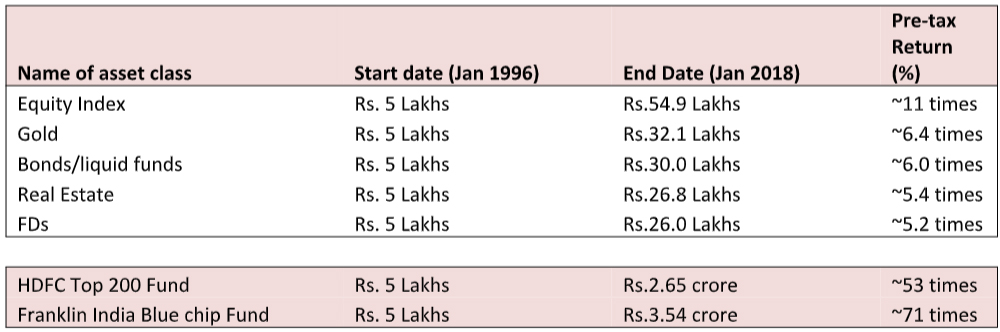

To start with, there are several available asset classes like stocks, MFs, bonds, FDs, real estate, gold or other

commodities where we can easily invest. Although neither of them would have a linear trend, we can compare

their performance during past 22 years. The table given below suggests that equity index (Nifty/Sensex) has

outperformed the other asset classes like bond, FDs, gold or real estate, massively over previous 22 years. These are pre-tax returns and even considering proposed 10% LTCG tax (budget 2018-19) on equity, this asset class would continue to outperform its peers where tax incidence is much higher vis-à-vis that of equity.

Performance of different asset classes

Apart from the names mentioned above, we have also tried to look at the performance of few large cap funds like HDFC top 200 and Franklin India blue chip during the same period. In fact these funds have generated much

superior returns vis-à-vis return generated by the equity index (even after adjusting for dividend payments) during the same time horizon. Without challenging the appropriate asset allocation strategy which depends on the risk profile as well as goals of the investor, we recommend to play the magic of compounding through greater exposure to equity as an asset class. I would like to conclude with the famous statement of Warren Buffet – “We don’t need to be smarter than the rest. We have to be more disciplined than the rest”.

Now it’s time to tell you the moral of the story, just like we ask our children to do so after reciting every story. In my opinion, moral of the story would be…. “You should start planning for wise investment as early as possible.

The earlier you start, the greater would be the magic of compounding”. Cheers & happy investing!!!

Regards

Saday Sinha