After a period of subdued growth marred by a spate of disruptions, Indian economy is recovering and has regained the fastest-growing economy tag. However, the growth revival story still carries some chinks in its armor, owing to higher than expected Fiscal deficits, Current account deficit, Inflation or Currency depreciation etc. This duality of revival and risk had the bearing on the market performance in recent months, further aggravated by the uncertainty around incoming elections and several unfavorable global factors.

Mid & Small cap stocks had a phenomenal run during 2014-17 and therefore funds positioning themselves in these categories attracted money at an unprecedented pace. Investors flocked to these mutual funds and investment managers struggled to deploy the fresh inflows in attractive investment opportunities. However, 2018 has not been so lucky; year-till-date (Jan-June 2018), S&P BSE Mid-Cap – TRI/S&P BSE Small-Cap – TRI have fallen 11% and 14%, respectively while S&P BSE Large Cap – TRI has delivered almost 5% positive return. The investors having higher exposure to Mid & Small cap funds in their portfolio have turned jittery when they see the value of their portfolio eroding.

Correction in the equity market is part and parcel of your life and you can’t do anything as an individual investor to stop a correction from occurring, if you own this asset class directly as equity or indirectly through mutual funds. In fact, the only people who should be worried about the market correction are those who have geared their trading strategy around the short term. Investors who own this asset class with slightly long-term horizon to meet their financial goals should not worry much. However, you should always reassess your holdings to ensure that the thesis of your purchase remains intact.

As market has seen correction in recent months, people have started using aphorism like “A rising tide lifts all boat” or “Only when the tide goes out do you discover who’s been swimming naked”. What Warren Buffet meant by the latter adage is that when the market is rising, or business conditions in general are easy and favorable, most participants look good. But when business conditions worsen and the stock market corrects, it is much easier to see who truly has a good business model. The retail investors who were riding the bandwagon without realizing the imperative risk involved have been caught on the wrong foot. Therefore, it is quite obvious that these naïve investors are looking for the expert advice. We will try to explain this conundrum with whatever little understanding we have (pun intended)!!!

First of all we would like to hit on the wrong perception that Mid-cap & Small-cap stocks are riskier and therefore the funds holding these stocks would also be risky. In fact, risk is not a function of its size but that of its business quality. There are several names like Eicher motors or twins of Bajaj Financial services or IndusInd bank which were small players ten years ago and now have joined the large-cap club. People generally interchange volatility characteristics with risk while explaining the traits of mid & small cap categories. Volatility is the NAV fluctuation of a fund but it does not distinguish between upward or downward trajectory of the price movement. So, rather saying that Mid & Small caps are more risky, we should say that they are more volatile animals to tame.

However, the unfettered growth of these Mid-cap & Small-cap funds on back of strong inflows in recent years may have overshadowed the potential risk to your portfolio. You may be excited looking at the rise in your fund’s NAV over the years but you should not overlook the liquidity risk associated with your fund’s top holdings. If the normal trading volumes in the holding stocks are so thin that AMC has to spend several months to liquidate its holding position without causing any material impact on its share price, your realizable NAV may be impacted severely. Suppose, your investment manager is facing huge redemption pressure and he is not able to find enough buyers for the stocks he wants to sell to meet the redemption requirements. In that scenario, he will be forced to sell those stocks which he does not want to sell and therefore negatively impacting the interest of left over investors.

Although Mid/Small cap mutual funds are more volatile and can be illiquid in certain conditions, they have the potential to generate higher returns for the investors as compared to the large cap funds in the long term. On the other hand, exposure to large cap mutual funds provides stability to your portfolio.

They are also highly liquid and provide good returns in the long-run. So, the question is not either large cap or mid/small cap but the prudent strategy of selecting the right combination of these three categories depending on your risk profile.

Now, you may ask this question… what percentage of my portfolio should be in the large cap?

Before assigning any number for an imaginary medium risk profile investor, we want to reiterate our philosophy. As an investor, you need to build a good mix in your investment portfolio which takes care of both stability as well as superior returns and in turn helps you multiply your wealth in the long-term.

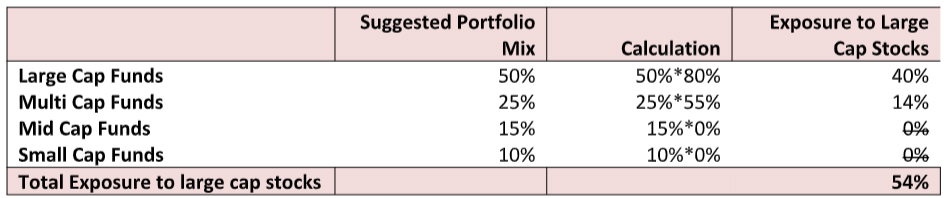

We advise this imaginary client to allocate 50% of his investment towards large-cap equity funds, 25% towards multi-cap equity funds, 15% towards mid-cap equity funds and rest 10% in the small-cap equity funds.

Source: DreamLadder Capital, SEBI classification, Ranking of stocks by AMFI as per the market cap criteria.

As per the ranking published by the AMFI on the basis of average market capitalization of listed companies during H2FY17, top 100 companies represent 69% of total average market cap. If you look at the Nifty50, it represents around 55% of total average market cap. So, 50% allocation to large cap mutual funds will represent 40% of the total market capitalization while another 25% towards multi-cap mutual funds will represent another 14-15% assuming these funds have 55-60% exposure to the large cap stocks.

Nonetheless, there is no defined optimal market cap allocation rule. If you are still young in 20’s or early 30’s, having higher risk appetite, you can allocate even more towards mid-cap and small-cap funds. On the other hand, if you are risk averse, your allocation to large cap can be even higher than what we have proposed for the above imaginary investor.

Conclusion:

The basic philosophy towards portfolio construction should be to have higher allocation to large cap equity mutual funds in your portfolio, if you are risk averse and have low risk appetite. On the other hand, if you have higher risk appetite, longer investment horizon and are willing to ride out the volatility, you should add mid-cap and small-cap equity mutual funds to your portfolio to get slightly higher returns. Rather than trying to predict when market will be excited about the mid & small cap themes, the prudent portfolio strategy should be to build a mix of different categories of funds in the right proportion, as per your risk appetite.